Governor Sarah Huckabee Sanders announced that Arkansas farmers receiving federal disaster and relief payments will not owe state income tax on those funds. The exemptions apply under Act 696 of 2025, which Sanders signed, along with existing provisions of Arkansas tax law that ensure farmers and ranchers are not taxed on critical relief funds.

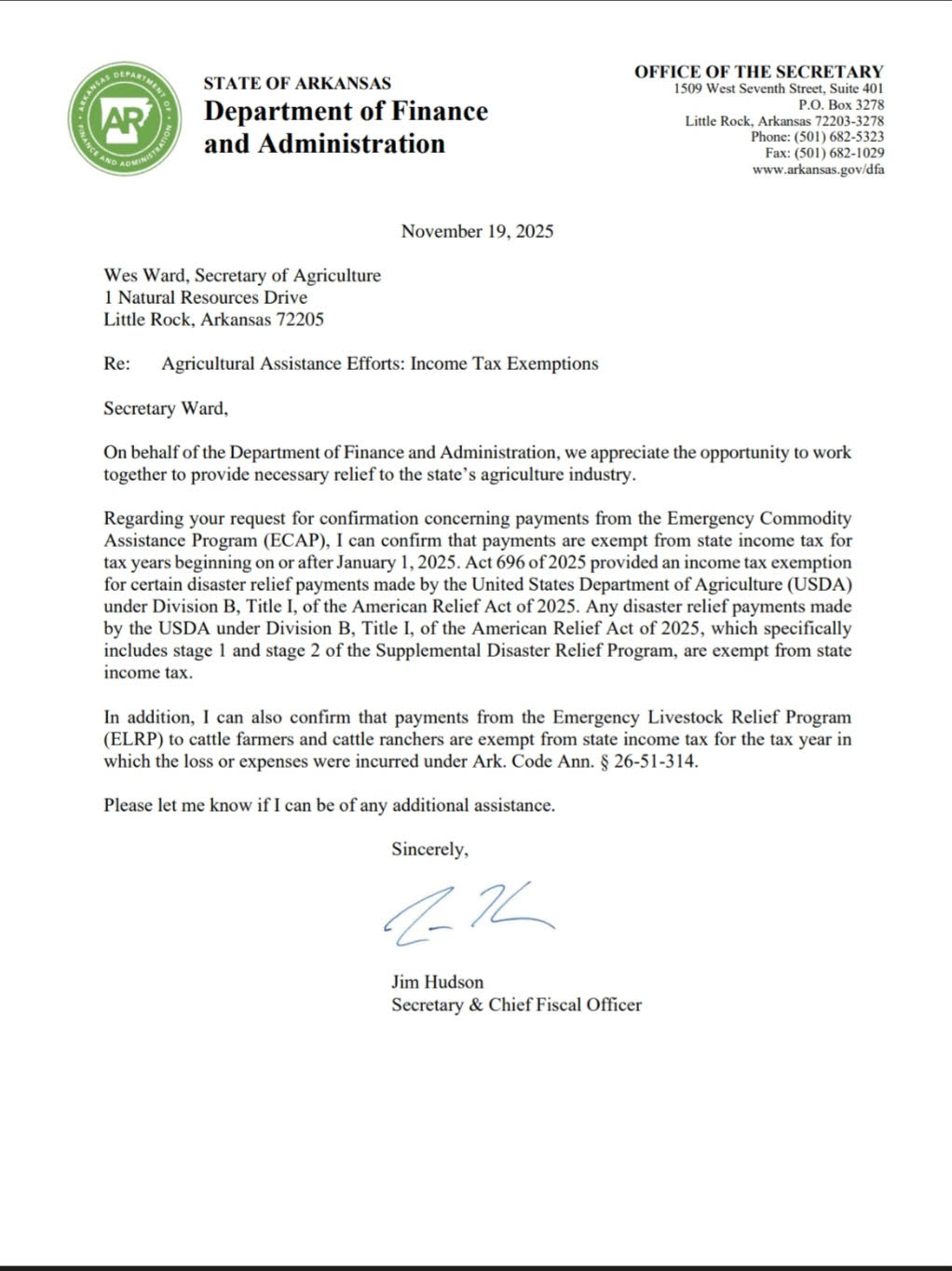

In a letter to Arkansas Department of Agriculture Secretary Wes Ward, Arkansas Department of Finance and Administration Secretary Jim Hudson confirmed that payments from both the Emergency Commodity Assistance Program (ECAP) and the Emergency Livestock Relief Program (ELRP) qualify for the exemption.

Sanders said Arkansas farmers are enduring “one of the most difficult seasons in modern memory,” adding that her administration is ensuring “recovering farmers don’t have to pay a huge tax bill on top of their other hardships.”

Agriculture Secretary Wes Ward said the exemptions ensure federal relief dollars “go directly to helping producers recover, reinvest, and remain strong heading into the next growing season.”

Program Impact

ECAP (2024 crop year): Arkansas farmers are expected to receive about $286.2 million to offset commodity losses and support continued production.

SDRP (2023–2024 disasters): Producers have received ~$65.71 million for crop and specialty-crop losses.

ELRP (2024 flooding): Eligible cattle producers in 18 counties may receive up to 60% of three months of feed costs.

Relevant Law

Act 696 (2025) exempts USDA payments under the American Relief Act of 2025.

A.C.A. § 26-51-314 exempts from income tax any payments made to a cattle farmer or cattle rancher from an agricultural disaster program.

Read Governor Sanders’ full press release: https://governor.arkansas.gov/news_post/sanders-announces-income-tax-exemptions-for-farmers-disaster-and-relief-payments