Why is liberal Democrat-Gazette columnist John Brummett spending so much time defending Governor Asa Hutchinson? Maybe because, as a liberal he likes Asa’s big government policies and Asa thwarting legislation by social conservatives.

And, why would a liberal defend raising the tax on groceries? Because it will “broaden the tax base” which means more money to grow government.

Brummett’s article: “Talk on taxes, minus spin”[i] has more spin than a laundromat at the end of a long weekend.

Let’s look at Brummett’s spin for higher grocery taxes and his spin to try to distance the Governor from the tax task force and the consideration of higher grocery taxes.

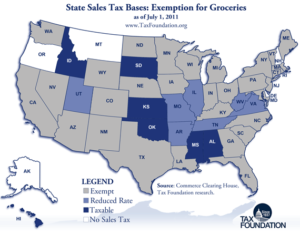

Make sure you read the bottom of the article showing how few states fully tax groceries and and that in most states groceries are fully exempt from taxes.

His Spin for Asa

Brummett claims raising the grocery tax with an income tax credit for low-income people is a great idea. But in case your are not convinced and are still mad about grocery tax discussions, Brummett doesn’t want you to blame Governor Hutchinson.

He tries to minimize Asa’s involvement in the task force by saying: “It is true that he supported establishing a legislative tax force..” No, the Governor didn’t just “support” creation of the task force. The tax task force is the Governor’s brain child – his baby.

- Asa is the one who proposed it.

- Asa is the one who set the parameters for its work.

- Asa either had his staff draft the legislation or put his stamp of approval on the details before he publicly proposed the task force. The legislation was ready to go because the multi-page bill was filed the following day.

- Asa’s desire to create a task force only makes sense if Asa was trying to stack the membership and get the result he wanted. There was zero need for a task force. The legislature already has long established and capable committees with the duty to study tax issues.

From the beginning Asa’s task force idea was a switcheroo. The Democrat-Gazette reported the idea came about to placate some Republican legislators who wanted to propose more tax relief in 2007.[iv] (Let’s study it – punt it down the road two years.) The only thing the legislators who wanted more tax cuts got was a task force that included the word “relief” in its name, while the mission of the task force, set by the Governor, doesn’t include anything about giving tax relief from Arkansas’ already high taxes.

His Spin for higher grocery taxes

In claiming that raising your grocery taxes is a great idea, Brummett cites a 2007 idea by Democrat Benny Petrus, when he was Speaker of the House of Representatives. “Rather than generally drawing down the sales tax on groceries for everybody, he proposed that we deliver targeted income-tax cuts only to low-income people.”

- Brummett knows but fails to mention that Speaker Petrus ultimately voted FOR the grocery tax cut in 2007. Speakers don’t always vote on bills, but Petrus made sure he was recorded as FOR. In the House, the grocery tax cut got 99 of 100 votes. The only reason it wasn’t unanimous was because one Representative was absent. It had already received unanimous approval in the Senate.

- Brummett knows but fails to mention that through political negotiations the grocery tax cut bill was part of a package of tax relief bills that also included …….. tax relief for low income persons.[ii]

- Brummett flip-flopped on grocery taxes. Now that he is trying to defend Asa, Brummett says higher grocery taxes with a low-income tax credit is a great idea. Brummett used to think lower grocery taxes were not only a good idea, but a greater moral imperative than income tax reductions, saying: “Income-tax reductions are not even the right tax-cut priority. Gov. Mike Beebe’s continued drawdown of the sales tax on people’s grocery food items remains the greater moral imperative. “[iii]

We are being sold the idea that raising grocery taxes in exchange for a low-income tax credit is a good thing. Not only is it a bad plan for anyone above the low-income level, it is a bad plan for low-income people. Let’s consider the grocery tax versus the income tax credit:

- With an income tax credit instead of lower grocery taxes, essentially low-income people would pay higher grocery taxes all year and then are eligible for an income tax credit the next year.

- There is no guarantee the tax credit would equal their benefit from lower grocery taxes. An income tax credit is just an arbitrary number based on an arbitrary calculation. It is not based on how much additional grocery tax the person actually paid. The Governor and legislature could set that number anywhere and could be very low.

- A taxpayer barely above the income limit for the tax credit would suffer the full brunt of the higher grocery tax and get no income tax credit.

- The benefit to the taxpayer from a reduced tax on groceries will grow to meet inflation. As the cost of food goes up the savings from the lower grocery tax keeps up with inflation. The benefit from an income tax is stagnate unless some arbitrary inflation factor is added, and even with an inflation factor it may not keep up with inflation.

Don’t be fooled. When big government advocates talk about raising grocery tax and giving low-income tax people a tax credit, it is NOT about helping low income people. It is about broadening the tax base to get MORE money of your money to grow government.

People despise grocery taxes

John Brummett and Governor Asa Hutchinson are out of touch with what people in Arkansas and around the country think about grocery taxes. Grocery taxes are despised.

Most states completely exempt groceries from both state and local sales tax.

Take a look at how poorly Arkansas compares with the rest of the nation.

Click on picture to see Tax Foundation’s report with full sized map.

Spin that!

[i] http://www.arkansasonline.com/news/2018/apr/12/talk-on-taxes-minus-spin-20180412/

[ii] http://www.arkansasonline.com/news/2007/feb/10/grocery-tax-bill-clears-house-20070210/

[iii] http://www.arkansasonline.com/news/2012/jun/03/taxation-vexation-20120603/

[iv] http://www.arkansasonline.com/news/2018/apr/06/tax-panel-lists-43-exemptions-20180406/