The Tax Reform and Relief Legislative Task Force is working on recommendations for changes to Arkansas tax law. The tax changes they are talking about would give back more revenue to the people than would be added back in from the reforms/increases. The government taking less money out of your pocket is a good thing.

The funding of the tax relief appears to have been determined by projecting how much revenue growth Arkansas is expecting and tithing back part of the increase to the people while keeping the rest of the new revenue for growing government. This is not a new plan. The Democrats used the same plan for decades, yet Arkansas is still ranked as a high tax state. Arkansas ranks far higher in taxes than all the surrounding states other than Louisiana, but even Louisiana is better than Arkansas when you compare the tax burden per person.

We are glad the task force is recommending some tax cuts and we are glad the economy is providing a larger surplus to deal with.

We hope the tax task force will take an important step beyond what the Democrats always did by asking:

- How much of a tax cut would it take to move Arkansas down the list of high tax states and down the list of high tax states per person?

- What is our plan to change Arkansas’ ranking to make it a more attractive state and how many years will it take to accomplish it?

Without asking these important questions we will always hear politicians bragging on some tax cut while keeping Arkansas as an unattractive high tax state.

The task force has an opportunity to make their effort about more than checking off a box on campaign literature saying, “I cut taxes.” They have the opportunity to create a plan for making Arkansas a more attractive state – a plan to lower our high tax status as compared to other states.

If there is no plan developed to improve Arkansas over even one state, then we will be playing the same ole tax cut game for decades without making Arkansas more competitive.

* * * * * * * * * *

Comparing Arkansas to Other States

High tax state

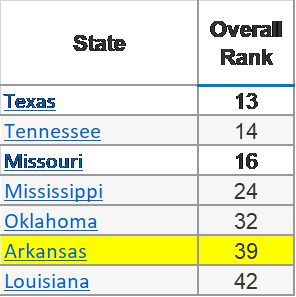

Arkansas ranked as a high tax state in the 2018 State Business Tax Climate Index by the Tax Foundation. Thirty-eight states ranked better than Arkansas and only eleven states ranked worse. The tax rates in five of the six surrounding states were better than the tax rates in Arkansas.

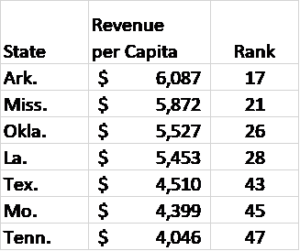

The tax burden per person in Arkansas is high when compared to other states. The Tax Foundation says Arkansas’ taxes make it the seventeenth highest state in the nation. Taxpayers in all six surrounding states pay less per person. The report is based on the 2014 fiscal year and appears in Facts & Figures 2017: How Does Your State Compare? It is Table 5 -State Revenue Per Capita.

Below is Arkansas’ high tax compared to the surrounding states.

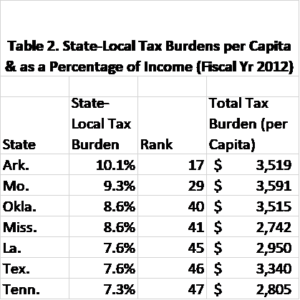

Arkansas did just as poorly when the Tax Foundation looked at the state-local tax burden per capita in Fiscal Year 2012.

* * * * * * * * * *