Week 7 Legislative Report 2023

Reminder to Legislators. Conduit is an economically conservative organization and scores bills based on the Conduit for Commerce Economic Freedom Filter: The negative side of that test asks, “Does it grow government, does it grow dependency on government, does it spend money we don’t have, or does it reduce government transparency?”….If the answer is “YES”, then vote “NO.” (If the opposite is true, and all things being equal, it would likely be a good bill and one where we may want to see a “YES” vote.)

Week 7 Summary of Conduit Bill Analysis (see Details Below):

OPPOSE

SB290 – 10% Pay Increase for Elected County Officials – OPPOSE

SB298 – Price Fixing for Government Nursing Faculty – OPPOSE

SB306 – Increasing Welfare Dependency with Expansion of Food Stamp Eligibility – OPPOSE

SUPPORT

HB1457 – Poll Watchers Bill of Rights – SUPPORT

HB1491 – No New Tax Assessments without Legislative Review – SUPPORT

SB294 – AR LEARNS Act – Educational Freedom Accounts – SUPPORT

SB304 – Capping Superintendent Buyout Packages – SUPPORT

Bill Details:

HB1457 – Poll Watchers Bill of Rights – SUPPORT

By: Rep. Tony Furman & Sen. Kim Hammer

This bill would establish a poll watcher bill of rights to ensure their ability to oversee election processes. A training program for poll watchers would be developed concerning the duties, rights, and responsibilities of poll watchers. Training will be required to be a poll watcher. Poll watchers will be allowed to view the election process within 3-6 feet from where people are identifying themselves to cast a ballot. Poll watchers will be allowed access to the entire voting process, including casting ballots, tabulating ballots, and any audits or recounts. If a public official purposely prevents a poll watcher from exercising their rights, that person can be charged with a Class A misdemeanor.

HB1491 – No New Tax Assessments without Legislative Review – SUPPORT

By: Rep. Fran Cavenaugh & Sen. Blake Johnson

This bill would prevent the Arkansas Department of Finance and Administration from assessing new taxes on items that had not previously been assessed without first receiving legislative review and approval. This will prevent the state from interpreting the law however they want to increase taxes without a review and approval of the people’s representatives.

An example of the DFA practice which this bill would stop is where DFA changes its policy and suddenly imposes sales taxes on farm equipment items which had not previously been subject to tax. This bill would stop that seemingly “discretionary” practice.

SB294 – AR LEARNS Act – Educational Freedom Accounts – SUPPORT

By: Sen. Breeanne Davis & Rep. Keith Brooks

This bill would be the largest overhaul of the education system in Arkansas’ history and establish school choice education freedom accounts to fund the education of children. Parents can choose which school or educational service is best for their child by directing tax dollars to help pay for that education. They can choose public schools, private schools, homeschool, extra tutoring, online school, or any combination of these so that the student is put first by the parent. The law would have a phased-in approach over three years providing universal choice by the 2025-2026 school year.

In Arkansas, only 35% of third graders can read at grade level. While we may have preferred that the bill took the stand that freedom and choice in education will increase teacher salaries by competition, (and not being sure adding money to solve our problems in education is the right solution since it has not worked in the past), under this bill new investments into public schools would be made, including raising minimum teacher salaries to $50,000, making Arkansas starting salaries the fourth highest in the country. All existing teachers will receive a raise of at least $2,000, with teachers being eligible to receive up to $10,000 in additional bonuses. It will provide literacy coaches around the state to increase literacy. Every K-3 student will be eligible for up to $500 to spend on additional education services to help with reading. It would also require students to read at a third-grade level before advancing to fourth grade.

A new high school career ready diploma will be established that will prepare students to go straight to work after graduating high school. Community service will be a requirement for graduation with students needing to complete 75 hours.

Teachers will be eligible for 12-weeks of paid maternity leave. The bill would eliminate regulations that make it hard to get rid of bad teachers, while maintaining due process rights.

Safety initiatives are also a big piece of the bill with crisis response training and mental health awareness training required for certain staff.

Instead of a one-size fits all approach to education, this legislation will truly provide multiple options for parents and their children’s education. It will additionally give a massive injection into the government school systems of hundreds of millions of dollars in new money annually. The bill has a majority of the House and Senate as co-sponsors, all but ensuring passage at some point.

After the bill passes, the amendments offered will be of interest to all.

SB304 – Capping Superintendent Buyout Packages – SUPPORT

By: Sen. Matt Stone & Rep. Justin Gonzales

This bill would cap contract buyout agreements of school superintendents to no more than twelve (12) months’ worth of state funds. The amount shall not exceed the amount owed to the superintendent under the remainder of their contract.

We support these caps and would prefer that they be capped in an even more aggressive rate.

SB290 – 10% Pay Increase for Elected County Officials – OPPOSE

By: Sen. Clint Penzo & Rep. Jimmy Gazaway

Counties in Arkansas continue to complain that their tax base (revenues) is shrinking in relation to their continually upward spiraling costs.

This bill would give a one-time ten percent (10%) cost of living increase (in lieu of the statutory 3% annual increase) for all elected county officers and justices of the peace beginning January 1, 2024.

During one of the greatest economic downturns in recent history, the 2011 Arkansas General Assembly changed the law to implement a flat annual 3% cost of living increase (COLA), which no longer required their bi-annual determination. Since that time (2011-2022) the national average inflation rate (which is the basis for COLA) increased overall nationally at the rate of 2.58% (which is nearly ½ percent per year lower than the salary increases for Arkansas’ elected county officials.) See US Inflation Rate by Year: 1929-2023 (thebalancemoney.com)

Conservatives say they want to shrink government. Therefore, Arkansas legislators should stop increased spending in all arenas.

SB298 – Price Fixing for Government Nursing Faculty – OPPOSE

By: Sen. Kim Hammer & Rep. Mary Bentley

This bill would require institutions of higher education that have graduate or undergraduate degrees in nursing to price fix a minimum salary for faculty in those nursing departments. The minimum would have to be at least the 50th percentile of what the American Association of Colleges and Nurses recommends paying faculty. This will ensure massive and ongoing raises, distorts market forces to set salaries, allows the industry to set taxpayer obligated pay, and would continue to increase the outrageous government spending in its healthcare takeover.

See “OpenGovPay” for more info on government salaries…. such as:

What a national medical association decides is appropriate pay in Arkansas does not seem relevant when determining what Arkansas can afford to pay its government employees.

https://opengovpay.com/employer/ar/university-of-arkansas-for-medical-sciences/2021

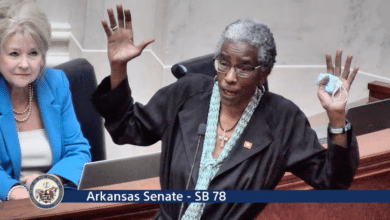

SB306 – Increasing Welfare Dependency with Expansion of Food Stamp Eligibility – OPPOSE

By: Sen. Jonathan Dismang & Sen. Clarke Tucker

This bill would require the state Department of Human Services to seek a waiver to increase the asset test from $2,750 to $12,500 for those applying for food stamps. This would allow people with cash of $12,500 in the bank to not be disqualified from receiving this welfare program intended for the truly needy. This bill would strip resources from the truly needy, increase dependency, spend more government money, and trap more people in welfare status.

Status of Bills Tracked by Conduit on Weekly Scorecard Reports:

OPPOSE

HB1087 – Increased Speeding Tickets + Required Community Service – OPPOSE

STATUS: Withdrawn by Author

HB1189 – New Licensure Regulations/Penalties on Behavior Analysts – OPPOSE

STATUS: Passed House Committee; Sent to House Floor

HB1237 – Increased Regulations and Costs for Ridesharing – OPPOSE

STATUS: Referred to Committee; Hearing scheduled 2/28/23

HB1275 – Banning Access to Paper Medical Records if Online Access Provided – OPPOSE

STATUS: Referred to Committee; no Hearing scheduled.

SB207 – Increased Franchise Taxes; Banning Businesses from Doing Business – OPPOSE

STATUS: Passed Senate (Vote); Referred to House Committee.

SB233/SB234/SB235 – Promoting Election Fraud and Cheating – OPPOSE

STATUS: Referred to Senate Committee; No Hearing scheduled

HB1422 – Special Tax Credits for Healthcare Professionals – OPPOSE

STATUS: Referred to House Committee; No hearing scheduled

SUPPORT

HB1012 – Increased Standard Deduction – SUPPORT

STATUS: Referred to Committee; On Deferred Agenda

HB1016 – Standard Deduction Increased by Inflation; No Cap – SUPPORT

STATUS: Referred to Committee; On Deferred Agenda

HB1026 – Prohibits Cities Enacting a Local Income Tax – SUPPORT

STATUS: Passed House (Vote); Passed Senate (Vote) Signed into law – Act 96 of 2023

HB1027 – Required Voter Approval for New/Increased A&P Taxes – SUPPORT

STATUS: Passed House (Vote); Referred to Senate Committee; No hearing scheduled

HB1032 – Increased Homestead Property Tax Credit – SUPPORT

STATUS: Heard in committee; Chair Eaves did not allow a vote. On Deferred Agenda.

HB1067 – No Residency Requirement for Firefighters – SUPPORT

STATUS: Heard in committee; Failed on voice vote – Rep. Carol Dalby & Municipal League helped kill.

SB5 – Telehealth for Vets – SUPPORT

STATUS: Heard on 1/24/23 in Committee; Opposition from out of state academics, cattle related associations; no vote taken. Amended 2/6, 2/8, and 2/20; Re-Referred to Committee

SB42 – Deregulation on Licensed Counselors – SUPPORT

STATUS: Passed Senate (Vote); Passed House (Vote); Signed into Law – Act 78 of 2023

HB1045 – Repeal of the “Throwback Rule” – SUPPORT

STATUS: Referred to Committee; On Deferred Agenda.

HB1082 – Occupational Therapist Licensing Compact – SUPPORT

STATUS: Passed House (Vote); Referred to Senate Committee; No hearing scheduled.

HB1149 – Prohibit Gifts from Lobbyists to Executive Branch Cabinet Secretaries – SUPPORT

STATUS: Withdrawn by the Author (1/25/23)

HB1155 – Increased Childcare Access – At-Home Childcare Providers – SUPPORT

STATUS: Passed House (Vote); Passed Senate (Vote); Signed into Law – Act 60 of 2023

SB80 – Exempt Capital Gains Tax from Property Conveyed via Eminent Domain – SUPPORT

STATUS: Referred to Committee; No hearing scheduled.

HB1196 – Part Time Work Requirement for Public Housing Benefits – SUPPORT

STATUS: Passed House (Vote); Passed Senate (Vote); Sent to Governor

HB1207 – Fast Track for Local Permits – SUPPORT

STATUS: Referred to Committee; Amended 2/20; No hearing scheduled

HB1239 – Repeal of Annual Franchise Tax on Businesses – SUPPORT

STATUS: Referred to Committee; on Deferred agenda.

SB90 – Occupational Licenses Streamlined for Out of State Equivalents – SUPPORT

STATUS: Referred to Committee; No hearing scheduled

SB125 – Increased Free Speech Protections on College Campuses – SUPPORT

STATUS: Presented in Committee, Pulled by Sponsor due to lack of support. Amended 2/8/23; Re-Referred to Committee.

HB1345 – Increased Tax Deduction for Teacher Classroom Expenses – SUPPORT

STATUS: Referred to Committee; On deferred agenda.

SB134 – Tax Cut on Used Vehicles, Trailers, Semi-Trailers – SUPPORT

STATUS: Referred to Committee; Amended 2/15; No hearing scheduled

HB1360 – Electrician Services Deregulation – SUPPORT

STATUS: Passed House (Vote); Referred to Senate committee

HB1382 – Tax Credits for Re-Entry to Work – SUPPORT

STATUS: Referred to House committee; no hearing scheduled.

HB1399 – Publication Requirements Reform for Cities and Counties – SUPPORT

STATUS: Referred to Committee; Amended 2/13; No hearing scheduled.

SB197 – Protection of Private Property Rights Against Local Regulations – SUPPORT

STATUS: Passed Senate (Vote); Referred to House committee;

SB206 – Partisan School Board Elections at General Elections with 2-Year Terms – SUPPORT

STATUS: Referred to committee; no hearing scheduled.

SB231 – Cooling Off Period for Legislators to Become Lobbyist-Consultants – SUPPORT

STATUS: Referred to committee; no hearing scheduled.

HB1401 – Reduction in Cash Welfare Program – SUPPORT

STATUS: Passed House (Vote); Referred to Senate committee

HB1407 – Improving Election Integrity – SUPPORT

STATUS: Passed House (Vote); Referred to Senate committee

HB1410 – Let Youth Work – No Government Certificate for Employment – SUPPORT

STATUS: Passed House (Vote); Referred to Senate committee

SB255 – No Outside Funding of Elections – SUPPORT

STATUS: Passed Senate (Vote); Referred to House committee

SB258 – No Absentee Drop Boxes for Elections – SUPPORT

STATUS: Passed Senate (Vote); Referred to House committee